Here’s what nobody tells you at industry conferences: Elite advisors who cross $1M in annual revenue do so 3.2x faster than those who eventually plateau at $800K—and it has nothing to do with working harder, having better credentials, or even superior investment performance.

The difference? They understand momentum physics.

Our analysis of high-performing advisory practices reveals a startling pattern: Top quartile firms generate 73% of their annual growth during concentrated 90-120 day “momentum windows,” while average practices spread their efforts evenly across the year like peanut butter on toast. The result? Practices in the first group achieve 40-60% annual growth rates while working fewer hours. Practices in the second group grind out 8-12% growth while constantly battling capacity constraints.

The traditional industry training circuit won’t tell you this, but the difference between incremental and exponential growth has little to do with effort—and everything to do with whether your growth feeds on itself.

The Linear Growth Trap

Most advisors are playing a game they can’t win. They’ve internalized the conventional wisdom that practice growth should be steady, predictable, and linear. “Just keep doing what you’re doing, stay patient, aim for that 10% annual increase.”

Sounds reasonable. It’s also why most practices never cross $1M in revenue.

Here’s the problem with linear growth thinking: it ignores how markets actually work. While you’re celebrating your disciplined 12% annual growth, three things are happening simultaneously. First, your fastest-growing competitors are capturing disproportionate market share through momentum effects you’re not even aware exist. Second, you’re missing the compounding advantages that come from strategic convergence—when multiple growth initiatives align and amplify each other. Third, you’re working harder every year for the same percentage gain, because your base grows but your systems don’t scale.

The hidden cost? Opportunity cost, talent limitations, and market share erosion that become irreversible over time.

Elite practitioners approach this completely differently. They engineer deliberate “momentum windows”—typically 90-120 day periods where they orchestrate 3-5 complementary growth initiatives that create compound effects. During these sprints, they target 40-60% annualized growth rates. Then they consolidate, systematize, and prepare for the next window.

Industry benchmarks reveal the paradox: sustained linear growth is actually harder to maintain than punctuated momentum cycles. Why? Because linear growth requires you to do more of the same indefinitely, hitting capacity constraints. Momentum-based growth leverages systems that scale and visibility that compounds.

The advisors breaking through to $1M+ aren’t discovering this framework at conferences—they’re building it systematically through our Revenue Acceleration Blueprint. Inside the Chairman’s Council, you’ll find the exact convergence strategies, visibility multiplier playbooks, and velocity protocols elite advisors use to compress 3-year growth timelines into 90-day sprints. [Access the complete implementation frameworks →]

The Momentum Equation Revealed

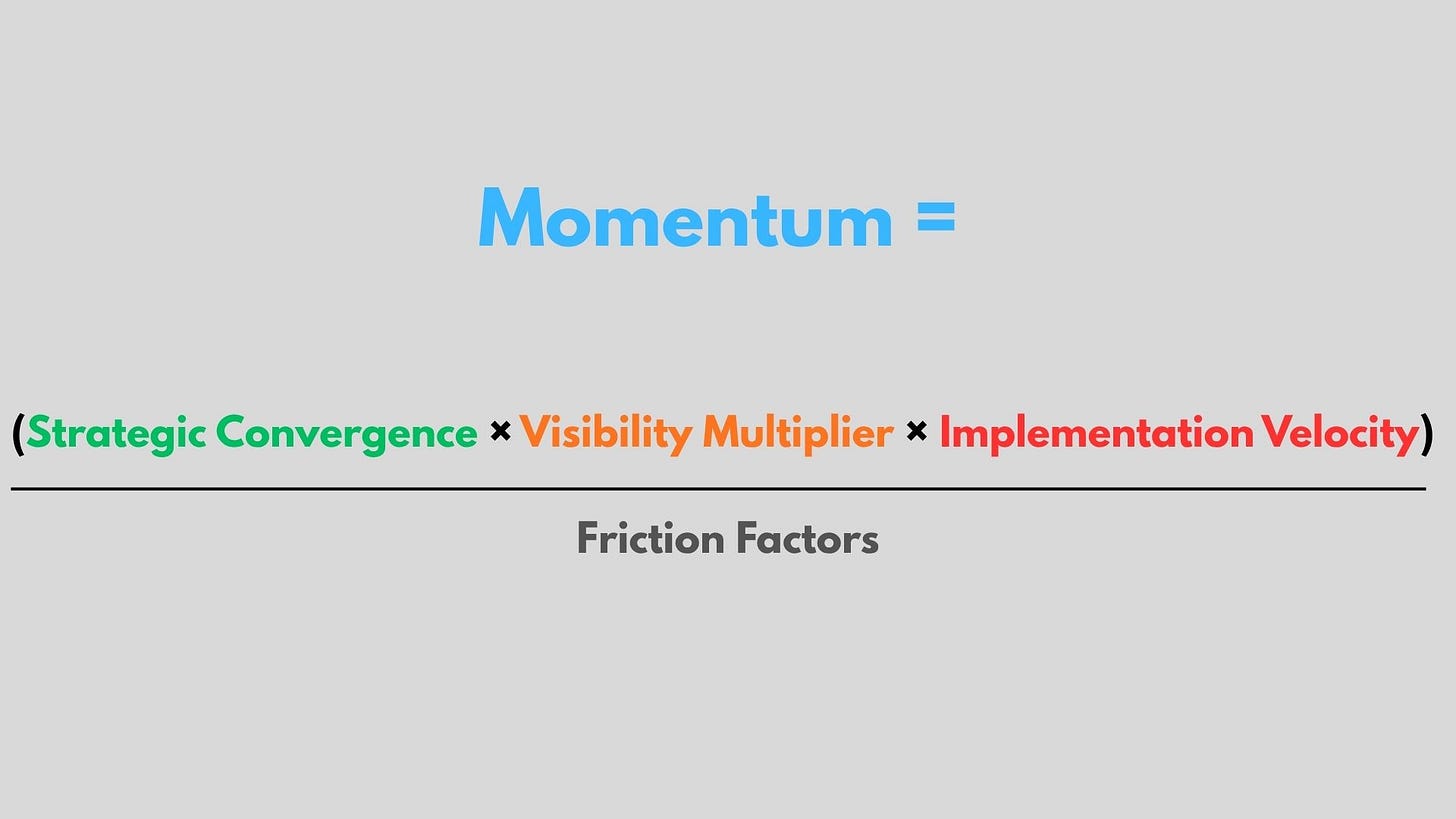

Here’s the framework top performers use—what we call the Momentum Equation:

Let me unpack each component with specifics you can implement.

Strategic Convergence: When 1+1+1 = 7

Strategic convergence happens when you launch multiple complementary initiatives simultaneously instead of sequentially. Example: A Boston-based advisor targeting tech executives launched three things in the same 90-day window—repositioned as “The Equity Compensation Authority,” published weekly LinkedIn content on RSU strategies, and activated relationships with three startup-focused attorneys with specific referral protocols.

The result? 2.8x more qualified prospects than the previous year’s total—in 90 days.

Our data shows convergence creates 2.3-3.1x returns versus sequential implementation. Why? Because each initiative amplifies the others. The LinkedIn content gives the attorneys something concrete to reference. The attorney relationships provide real client stories for content. The niche positioning makes both efforts dramatically more effective.

Elite advisors cluster 3-5 complementary initiatives into 90-120 day sprints. They don’t try to do everything; they engineer initiatives that create natural synergies. Launching a niche position without content distribution? That’s not convergence. Publishing content without relationship activation? Also not convergence. Doing both simultaneously with a clear positioning strategy? That’s convergence—and that’s how you generate disproportionate returns.

Visibility Multiplier: How Awareness Compounds Awareness

Most advisors think about visibility linearly: more marketing = more prospects. Elite advisors understand the multiplier effect: the right visibility creates cascading awareness that compounds geometrically.

Here’s how it works. A Chicago advisor speaks at a local CPA conference (Visibility Event 1). Three attendees connect on LinkedIn and engage with her content over the next month (Visibility Event 2). One CPA mentions her in a trade publication interview (Visibility Event 3). A prospect discovers that article while researching advisors (Visibility Event 4). The prospect notices she’s connected to his CPA (Visibility Event 5).

Each visibility event amplifies the impact of previous events. We call this “visibility stacking”—deliberately designing initiatives that naturally amplify each other across multiple platforms.

The specific tactic top performers use? The “3-platform convergence” approach. They dominate three interconnected platforms simultaneously—typically LinkedIn + industry events + strategic partnerships. Not five platforms with diffuse effort. Three, with concentrated force that creates multiplier effects.

A Toronto advisor used this approach to go from 8 inbound prospect inquiries annually to 47 in 18 months, without increasing his marketing budget. The secret? Visibility multiplication through strategic platform selection and content that referenced itself across channels.

Implementation Velocity: Speed Is a Strategic Weapon

Here’s a contrarian insight that separates elite practitioners from everyone else: Moving at 80% quality but 2x speed typically generates more value than moving at 100% quality but half the speed.

Why? Because in momentum-based growth, speed creates compound advantages. Fast movers capture market attention first. They learn faster through real-world feedback. They build confidence and refine approaches while slow movers are still in planning mode.

Our data shows practices that complete initiatives in 90 days versus 180 days capture 40-60% more value from the same activities. The reason isn’t mysterious—it’s about market timing, competitive positioning, and learning velocity.

Elite advisors use what we call the “decision velocity protocol”: they make irreversible decisions in under 48 hours and reversible decisions in under 4 hours. They set “good enough” thresholds: “If this initiative achieves 75% of the ideal outcome, we execute immediately rather than optimizing for 100%.”

The mantra? Momentum dies in committees and complexity. Elite advisors maintain implementation velocity by protecting decision-making from death by consensus.

Friction Factors: The Momentum Killers

Even perfect strategic convergence, visibility multiplication, and implementation velocity fail if friction factors drain your momentum before it builds.

The most common friction points? Decision paralysis disguised as strategic thinking. Perfectionism masquerading as quality standards. Capacity constraints you could solve but haven’t. Low-value client relationships consuming energy that should fuel growth.

One Dallas advisor tracked his decision-making velocity and discovered he was taking an average of 23 days to make reversible marketing decisions. After implementing rapid decision frameworks, he reduced this to 3 days. The result? He implemented 7 major growth initiatives in one year instead of his historical 2-3.

The most valuable friction-removal strategy? Systematic capacity expansion through delegation protocols and service model redesign. Elite advisors eliminate friction by asking: “What would need to be true for this to be easy?”

You now understand the Momentum Equation. What you haven’t seen yet: the specific competitive advantage window opening in 2025-2026, the asymmetric ROI data that justifies momentum investments, and the week-by-week implementation protocol. Chairman’s Council members get the complete 90-Day Momentum Sprint framework, and the leading indicator dashboards top performers track obsessively. [Unlock the full implementation system →]

The Competitive Advantage Window

Here’s what makes this moment unique: we’re entering a 18-24 month window where