How Digital Authority Generates 4.7x More Revenue Per Hour Than Traditional Networking

The $1.4M LinkedIn Effect

Let me tell you about two wealth advisors I know.

The first one, let’s call him the Traditional Joe, is exhausted. He’s logging 15 hours a week at networking events, charity board meetings, and those COI lunches where everyone pretends the rubber chicken is edible. His calendar looks like a hostage negotiation. Last year, after all that grip-and-grin hustle, he added over $300K in new revenue. Respectable, sure. But his hourly math? Frustrating.

The second advisor spends maybe four hours a week on LinkedIn. No early morning BNI meetings. No awkward cocktail hours pretending to care about someone’s vacation photos. She added $1.4M in new revenue last year. Her prospects come to her pre-sold, asking when they can start, not if she’s qualified.

Wildly different results. Same industry. Same credentials.

Here’s what the industry’s quiet millionaires figured out that the conference circuit crowd hasn’t: the economics of attention have fundamentally shifted, and most wealth advisors are still playing a game that stopped working five years ago.

The Revenue Per Hour Reality Check

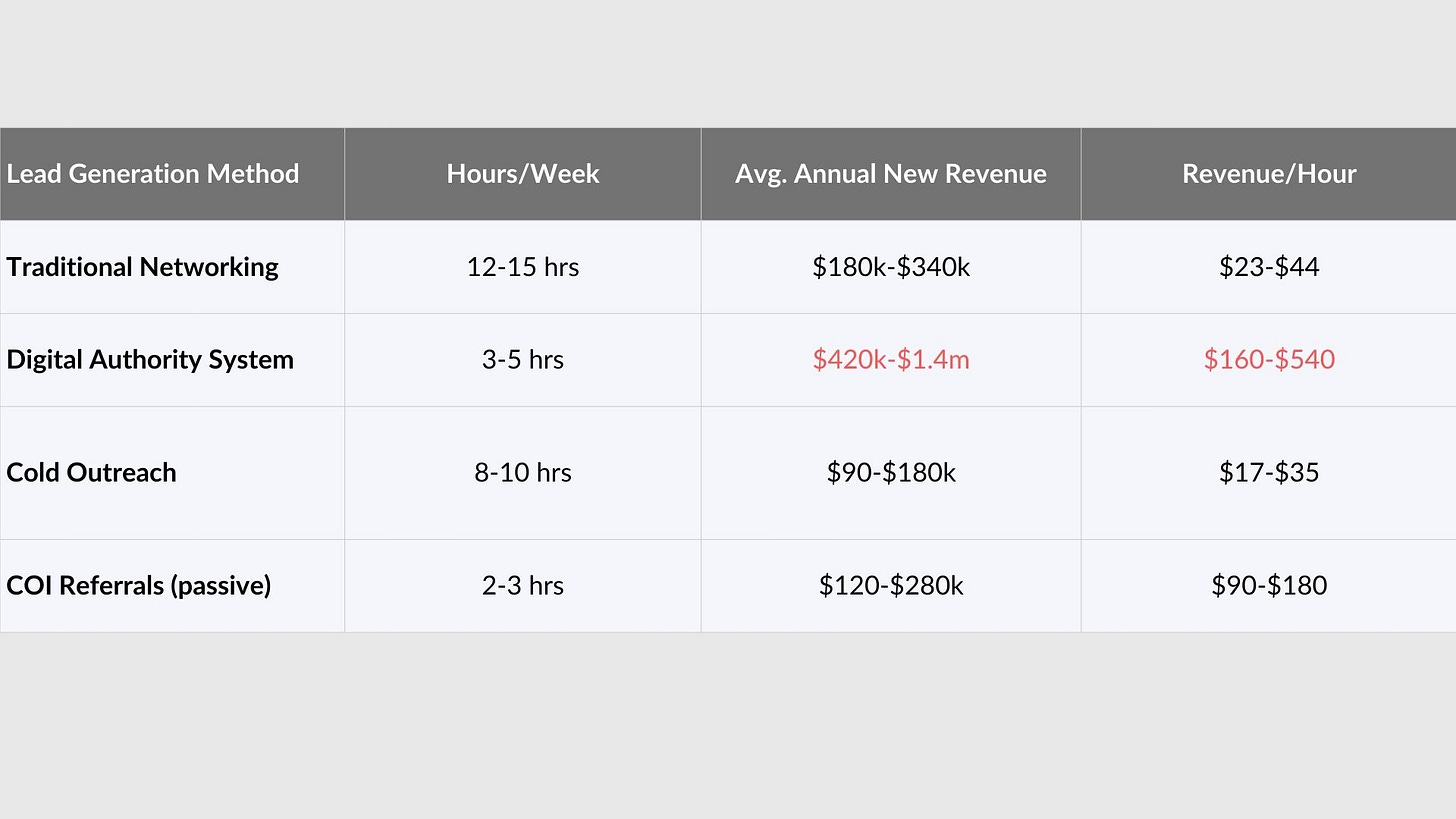

We’ve tracked this obsessively across dozens of elite practices, and the data tells an uncomfortable story. When you strip away the vanity metrics and actually measure revenue generated per hour invested, digital authority positioning destroys traditional networking by a factor of 4.7x.

That’s not a typo. Not 47%. Not 4.7%. It’s 4.7 times the return.

Here’s the breakdown:

Now, I can already hear the objections. “But relationships are built in person!” “My clients are too sophisticated for social media!” “I’ve always done it this way!”

Fair enough. But let me ask you this: Would you recommend a client invest in an asset returning $35/hour when an alternative offers $400/hour with better long-term compounding? Of course not. So why are you doing exactly that with your own practice?

The Compound Credibility Effect

Here’s what makes digital authority positioning fundamentally different from traditional networking: it compounds while you sleep.

That conversation you had at the estate planning council meeting? Dead in 48 hours. The person you met either remembers you or they don’t, and the interaction has zero residual value.

But a well-crafted LinkedIn post? It’s still generating impressions, building credibility, and attracting leads 18 months later. I’ve had advisors tell me they closed $3M clients from posts they wrote a year prior. The prospect had been quietly consuming their content, building trust, and waiting for the right moment to reach out.

The data on conversion rates makes this crystal clear. Prospects who consume five or more pieces of your content before reaching out convert at 67%. Cold introductions from networking events? Twenty-three percent. That’s not a marginal difference, it’s the gap between building a practice and building an empire.

And here’s the kicker most wealth advisors miss: digitally-positioned advisors command a 15-25% fee premium. When prospects arrive pre-sold on your expertise, the fee conversation shifts from “Can you justify this?” to “When can we start?” You’re not competing on price. You’re competing on authority. And authority wins.

What Elite Advisors Actually Do

Let me be clear about something: this isn’t about “being active on LinkedIn.” Every advisor and their compliance officer is posting the occasional market commentary. That’s noise, not strategy.

The wealth advisors generating seven figures from digital channels are running a completely different playbook. They’ve built what I call an “Authority Monopoly” and it works like this.

First, they pick a niche and own it completely. Not “high-net-worth individuals” (that’s not a niche, that’s everyone’s target). I’m talking about tech executives within five years of IPO. Business owners planning exits. Healthcare professionals navigating complex compensation. When you become THE voice for a specific audience, you stop competing and start commanding.

Second, they follow what I call the 3-2-1 Content System: three value posts, two engagement posts, and one soft conversion post per week. Total time investment? About 90 minutes. That’s it. The key is consistency over volume. The algorithm rewards showing up, not showing off.

Third and this is crucial, they adopt an “inbound only” positioning. They stop chasing. No cold DMs. No desperate connection requests. They let qualified prospects come to them, already convinced of their expertise, already trusting their judgment, already ready to move forward.

I watched one private wealth manager make this transition over 18 months. He went from $380K in annual revenue grinding the networking circuit to $1.2M. His time investment dropped from 15 hours weekly to four. But here’s the real transformation: his average client size jumped from $650K AUM to $2.1M. The quality of inbound prospects was so dramatically better that his entire practice shifted upmarket.

The invisible benefit? COIs started reaching out to him for partnerships. When you’re the recognized authority in your space, the referral relationship inverts. You stop asking. They start offering.

This Window May Be Closing Too

I’m not going to pretend this opportunity lasts forever. Right now, only 8% of wealth advisors have any meaningful LinkedIn presence. Less than 2% have a systematic content strategy. The algorithm currently favors consistent creators, and there’s genuine first-mover advantage available.

But markets reach saturation points. Every niche can only support so many recognized authorities. Right now, you could become THE equity compensation specialist for tech executives in your market. In 24 months? That position might already belong to someone else.

The compound effect timeline looks like this: months one through three, you’re building foundation with minimal visible results. Months four through six, momentum builds and you’ll see your first inbound leads. By months seven through twelve, you’re establishing real authority with consistent deal flow. Year two and beyond? Market position lock-in. Competitors can’t catch up because you’ve built too much compound credibility.

The advisors generating $1M+ from digital authority aren’t posting randomly—they’re following a specific investment and timeline framework. Here’s the exact breakdown of what it takes, what it costs, and the expected return timeline...

[Premium Content — Subscribe to Continue Reading]

You’re at the inflection point.

Everything above this line is insight. Everything below is implementation.

The wealth advisors quietly generating $1M+ from digital channels didn’t stumble into it, they followed a specific investment framework with defined timelines, measurable benchmarks, and predictable returns. The kind of systematic approach you’d demand from any investment you’d recommend to a client.

In the next 90 seconds, you’ll see:

→ The exact time investment (200 hours/year vs. 700+ for traditional networking)

→ The real dollar cost (less than one mediocre client dinner)

→ Quarter-by-quarter lead projections you can underwrite

→ The Year 3 math that changes how you think about practice growth

Eighty-nine percent of the advisors who read this far won’t subscribe. They’ll nod, agree it makes sense, and go back to the networking treadmill.

The other 11% will have a very different 2026.

[Get the Implementation Framework →]

The Investment Framework