How Elite Advisors Generate More Revenue From Partnerships Than From Marketing

The Million Dollar Alliance Effect

Revenue Acceleration Intelligence | Chairman’s Council | February 9, 2026

This should make you rethink your entire growth strategy: the average elite Wealth Advisor with a formalized partnership system generates over $1 million in additional annual revenue from strategic alliances alone. Not from Google Ads. Not from seminar chicken dinners. Not from those LinkedIn DMs that disappear into the void like digital message-in-a-bottles nobody asked for.

From partnerships.

Meanwhile, most advisors are doing what they’ve always done, allocating 60 to 70 percent of their growth budget to direct marketing and hoping something sticks. Competing for the same eyeballs, bidding up the same ad costs, wondering why cost per acquisition keeps climbing while close rates keep dropping. The top 3% of Private Wealth Managers figured out a different game entirely. They stopped competing for attention and started engineering alliances that deliver pre-qualified, high-trust prospects on a recurring basis.

Every Wealth Advisor knows they “should” have CPA relationships. The elite ones built something fundamentally different, and the revenue gap is staggering.

The Numbers Don’t Lie, But They Might Sting

Let’s get specific, because vague claims about “the power of referrals” are what your branch manager tells you at the Monday morning meeting. This is different.

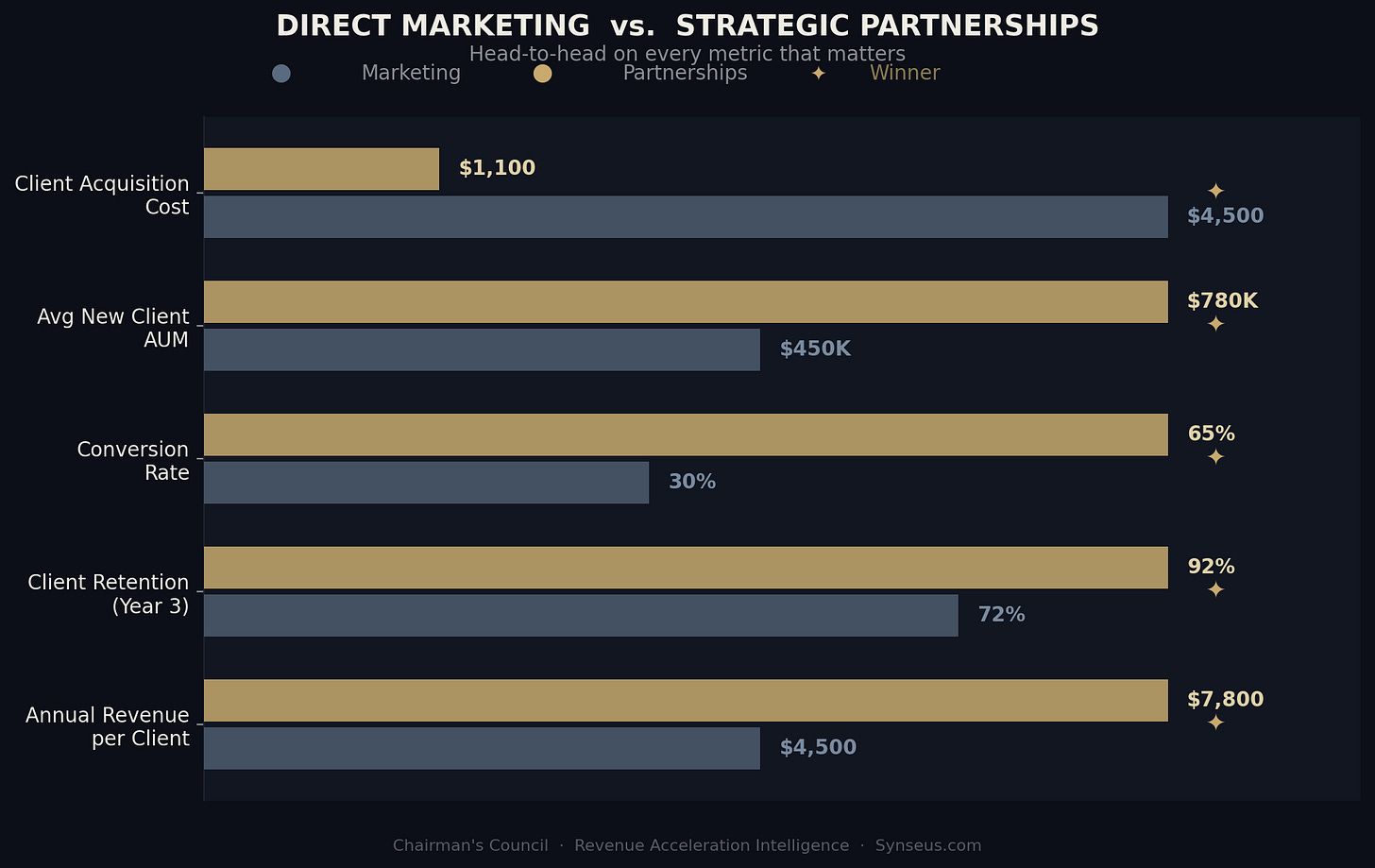

When you compare the economics of direct marketing against a structured partnership system, the delta isn’t marginal. It’s a different sport.

Partnership-sourced clients arrive at 40 to 60 percent lower acquisition cost, carry nearly double the AUM, convert at almost triple the rate, and stick around 20 to 30 percent longer. The ROI gap isn’t subtle, it’s embarrassing for anyone still dumping budget into Facebook ads hoping HNW prospects scroll past cat videos long enough to click through.

The reason is straightforward: a partnership referral arrives pre-sold. When a trusted CPA tells a $2M household “you need to talk to this Wealth Advisor,” that prospect isn’t comparison-shopping on Google. They’re calling to set up a meeting. Trust transfer is the single most valuable asset in this business, and you can’t buy it with ad spend.

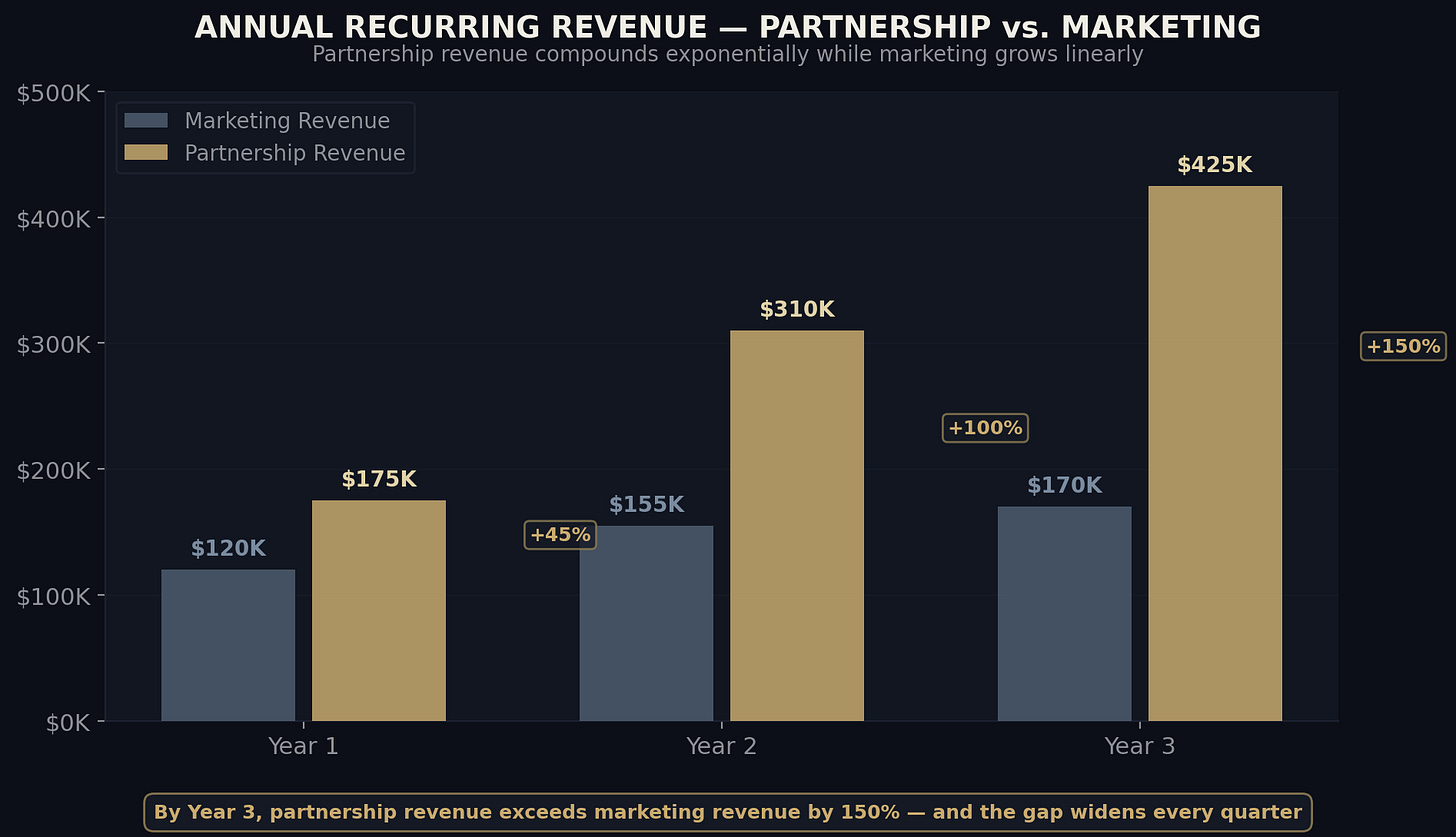

The Compounding Curve Is Everything

Here’s where the math gets really interesting and where partnerships separate from every other growth channel. Marketing spend delivers diminishing marginal returns. Year over year, you’re fighting more noise, higher costs, and shorter attention spans. Partnerships do the opposite. They compound.

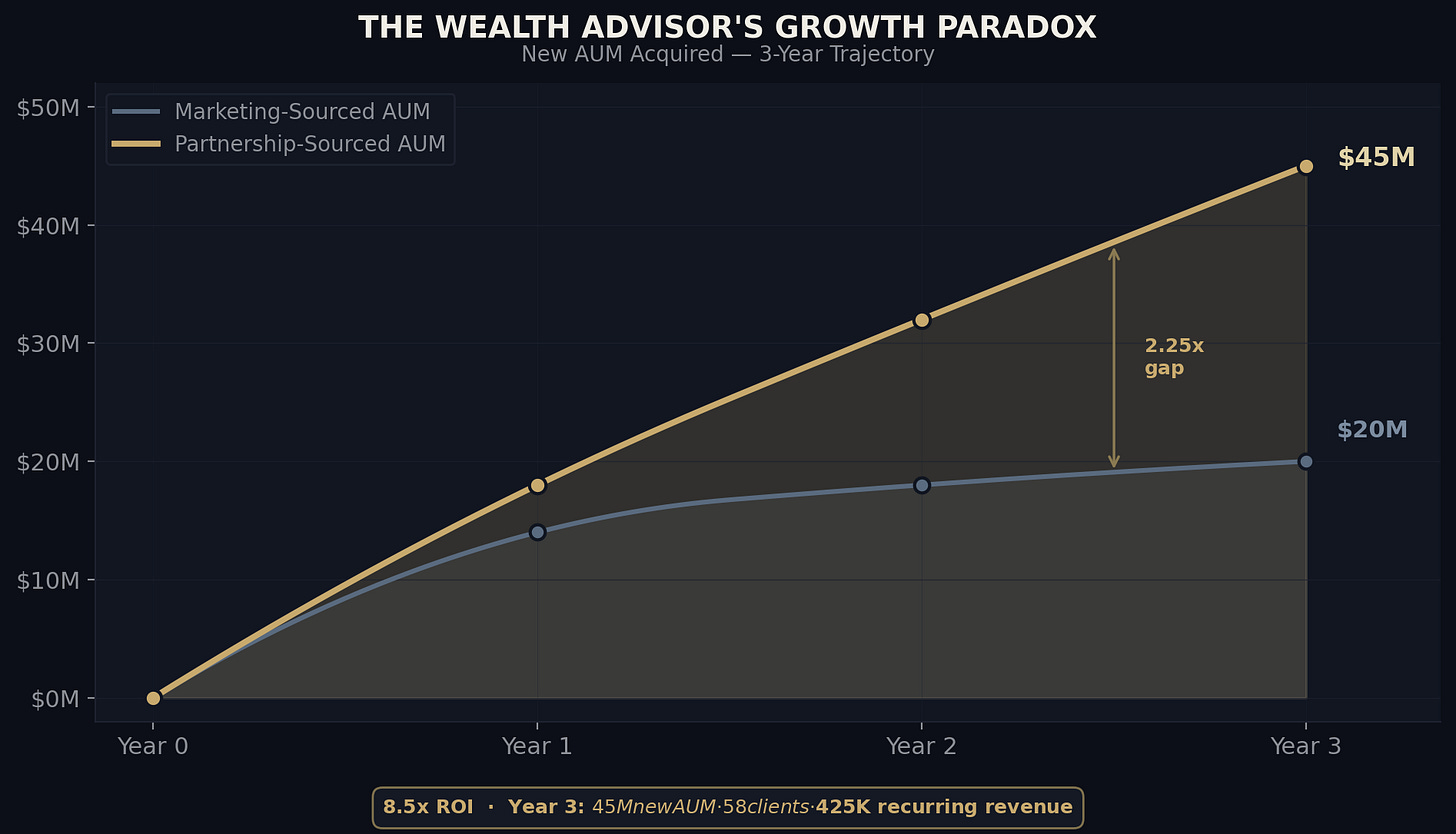

Consider the trajectory from one advisory practice that shifted from informal networking to a formalized alliance system. Year 1: $18 million in new AUM from 23 new clients — the ramp-up phase. Year 2, as alliances deepened and referral mechanics tightened: $32 million from 41 new clients. Year 3? The system matured into $45 million in new AUM across 58 new clients, producing $425,000 in annual recurring revenue from partnership-sourced business alone.

That’s an 8.5x return on partnership development investment. And unlike your marketing budget, which resets to zero every January, partnership equity carries forward. Every quarter of cultivation reduces friction and increases flow. Your competitors are on a treadmill. You’re building a flywheel.

What the Elite Actually Do Differently

Now, let’s talk about what separates the Wealth Advisors generating $1M from alliances from the ones buying a CPA lunch twice a year and wondering why the phone never rings. If your idea of a “partnership strategy” is leaving your business card in an accountant’s lobby next to the bowl of peppermints, we need to talk.

The top performers do four things that everyone else skips.

They flip the value proposition entirely. One Private Wealth Manager generating $2.2 million annually, transformed his approach by asking a different question. Instead of “Can you refer clients to me?” he led with “Here’s how we can help you build YOUR business.” He created specific solutions for CPA firm challenges: expanding their consulting revenue, supporting their client service process, strengthening their own value proposition. The result? Formal alliances with three regional CPA firms generating over $12 million in new assets annually. Referrals became a byproduct of genuine value creation, not a favor being asked.

They systematize, not socialize. Elite advisors build automated referral systems with technology-supported workflows, structured partner onboarding, and quarterly strategy reviews. Every step from client identification to introduction protocol to follow-up is mapped and repeatable. This isn’t relationship-dependent. It’s system-dependent. That distinction is worth millions.

They formalize compensation. Revenue-sharing models that align partner incentives with client value creation, not just transaction completion. The most effective structures combine immediate referral compensation with long-term performance incentives that encourage partners to keep the pipeline flowing year after year. When your CPA partner has a financial reason to think about your practice every time they sit across from a high-net-worth client, you’ve built something your competitors can’t replicate with a steak dinner.

They measure ruthlessly. Quarterly alliance optimization reviews tracking referral volume, conversion rate, client satisfaction, revenue generation, and partner satisfaction. When systematic feedback and accountability frameworks are implemented, partner performance improves by 30 to 50 percent. If an alliance isn’t producing, they diagnose the bottleneck and fix it or they exit and reallocate that energy to a partner who will deliver.

February Is The Window You Can’t Afford to Miss

Here’s the timing play that makes this urgent right now. Tax season is approaching, and CPAs are about to be buried in returns and client requests. The Wealth Advisors who approach them in February before the chaos, with a structured value proposition and a formal alliance framework will lock in partnerships before competitors even think about picking up the phone.

By March, every advisor in your market will remember they “should call their CPA contacts.” The elite ones already had the formal alliance agreement signed in January. Q1 is when partnerships are forged. Q2 is when they pay off. The professionals you want to partner with are making strategic decisions right now about who they want to align with for the year ahead. If you’re not in that conversation this month, you’re waiting until next year.

Your Move

Partnership revenue isn’t a “nice to have” supplement to your marketing budget. For elite Wealth Advisors, it IS the growth engine, outperforming traditional marketing on every metric that matters.

Use the Power of Synseus.com to Elevate Your Game

If you want to model what this looks like for your practice, run your numbers through the Partnership Revenue Simulator & the Partnership Value Calculator in the Advisor Tools section at Synseus.com. Five minutes to see what a formalized alliance system could add to your T-12.

On Monday, I’m breaking down the exact CPA Coup Strategy, how elite Wealth Advisors build exclusive referral relationships while their competitors get ghosted. If today’s data was eye-opening, wait until you see the playbook.

The advisors who build these systems in Q1 will spend the rest of 2026 watching them compound. Everyone else will still be refreshing their ad dashboards.

The intelligence is here. The window is now.

Chairman’s Council delivers unconventional strategies for ambitious Wealth Management professionals targeting exponential AUM and revenue growth.