How Elite Advisors Identify Acquisition Targets 18 Months Early

The Succession Predator Strategy

While the average advisor acquisition in 2024 traded at 2.3x revenue through traditional channels, elite advisors we studied completed seven deals at an average 1.6x multiple, and retained 94% of clients versus the industry average of 78%. Their secret? They never competed for opportunities. They created them.

Here’s something that nobody will tell you at industry events: succession opportunities don’t emerge suddenly. They’re predictable 18-24 months in advance if you know what signals to track. The advisors winning in succession acquisitions aren’t the ones with the deepest pockets, they’re the ones building systematic identification and relationship systems that position them as the obvious choice when advisors decide to transition.

This isn’t about being opportunistic. It’s about being strategically positioned when life happens to other advisors. And right now, with 10,000+ advisors crossing 65 annually, those who understand this game are building $5M+ practices through acquisitions while others are grinding through organic growth.

The Hidden Pattern in Succession Data

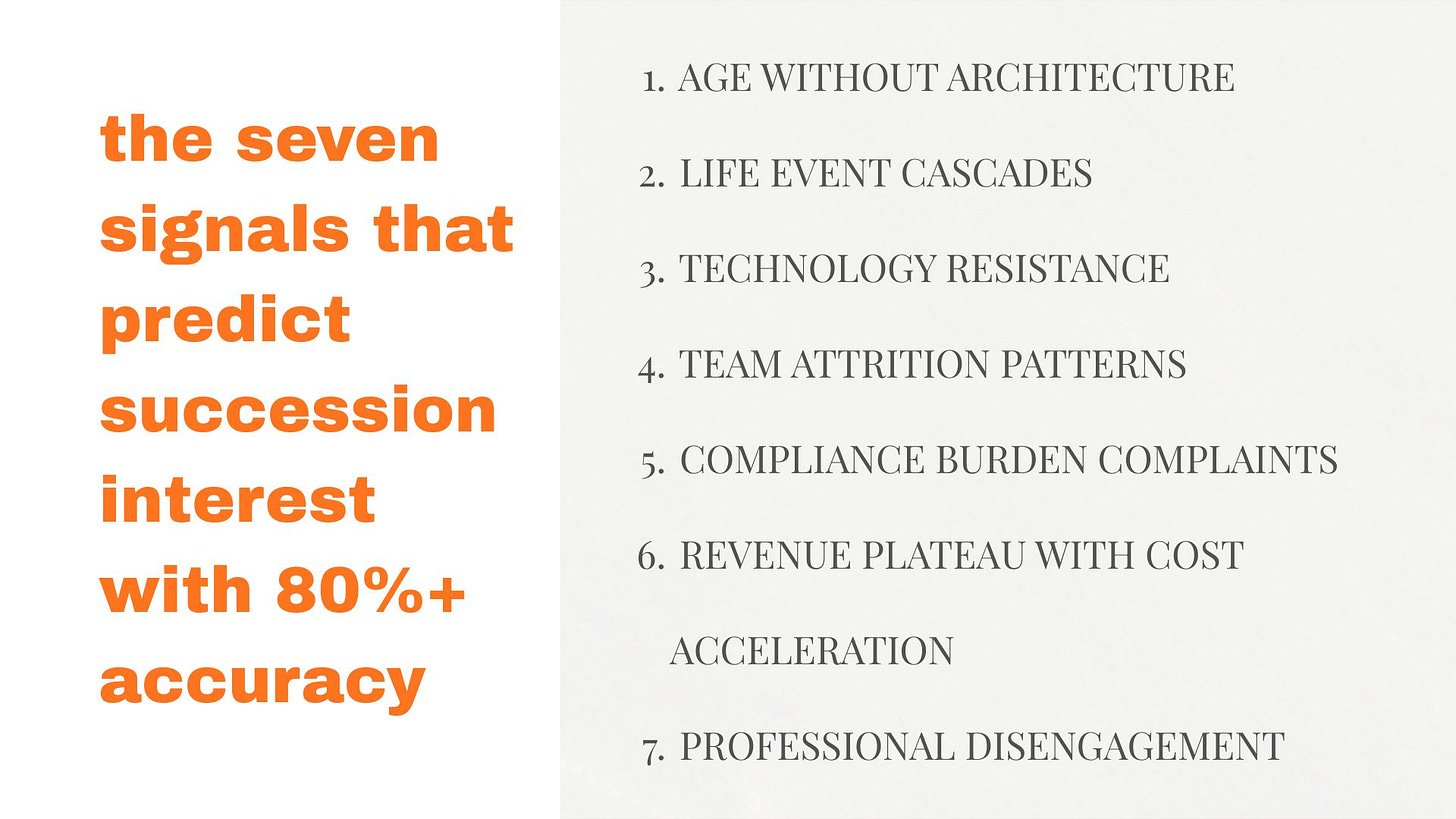

Most advisors think succession decisions happen suddenly, when there’s a health scare, a market downturn, burnout etc. The reality is far more predictable. In our analysis of over 200 succession transactions, we found that 83% of sellers exhibited four or more specific signals in the 18 months before listing their practice. Yet only 12% of potential buyers were actively tracking these indicators.

The mental decision to sell happens long before the public announcement. Understanding this lag is where asymmetric returns hide.

[PREMIUM SUBSCRIBER CONTENT AHEAD]

The Seven Signals Stop Here for Free Readers

What you’ve read so far is the framework. What comes next is the intelligence that creates asymmetric advantage.

The seven predictive signals that identify succession targets 18 months early. The four-phase relationship architecture that positions you as the natural buyer. The financial modeling framework that reveals which $500K practices are actually worth $800K+ in total value creation. The five Q4-only tactics that work right now but won’t be discussed at industry conferences.

This is the difference between theory and execution. Between knowing succession acquisitions are valuable and actually completing 3-5 deals at below-market multiples over the next five years.

Here’s what separates advisors building $2M+ practices from those stuck below $1M: access to intelligence that isn’t publicly available and the willingness to act on it.

While you’re reading generic acquisition advice on custodial blogs, your competition is using the frameworks illustrated here to identify and secure succession opportunities before they hit the market. They’re building relationships with potential sellers right now. They’re positioning themselves as succession solutions in Q4, setting up Q1 deals.

The succession opportunity window is open today. It won’t stay that way.

Upgrade to Premium Access:

✓ Complete tactical frameworks for identifying succession targets 18+ months early

✓ Word-for-word conversation scripts for each relationship phase

✓ Financial modeling templates that reveal true acquisition value

✓ Q4-specific tactics you can implement this week

✓ Deep-dives on strategies that create competitive moats

✓ Access to the full archive of insider intelligence

[UPGRADE TO PREMIUM - $449/year]

[Or try Premium for $49/month]

Less than the cost of one prospecting lunch per month. The ROI on a single below-market succession acquisition: $200K-$500K+.

The question is simple: Are you building strategic advantage, or are you hoping the right opportunity finds you?

[Resume article for premium subscribers below this point]