The Alliance Approach for Building Revenue-Generating Professional Partnerships

Every Wealth Advisor should rethink their entire COI strategy, 82% of Financial Advisors describe their CPA relationships as “good” or “excellent.” Yet only 11% of those same advisors receive more than five qualified referrals per year from those relationships. Let that sink in for a moment. The average Advisor spends roughly $4,200 annually on COI lunches, dinners, golf outings, and holiday gift baskets, and the return on that investment is a grand total of 2.3 referrals. That’s not a great strategy at all, it’s an expensive hobby.

Meanwhile, there’s a small cohort of elite Private Wealth Managers who generate 75 or more qualified referrals annually from the same types of professional partners. Same CPAs, same attorneys, same market. The difference isn’t charm, charisma, or some supernatural gift for schmoozing. The difference is that these top performers stopped networking and started engineering. They built what we call an Alliance approach, and it’s the single most asymmetric growth lever available to any Financial Advisor who’s serious about scaling past $500K.

The Death of the “Lunch and Hope” Model

Let’s be honest about something the industry doesn’t want to talk about. The traditional Center of Influence playbook is broken. You know the one: take a CPA to lunch, mention that you’d “love to help their clients,” follow up with a few emails, and then wait by the phone like it’s prom night. It was mediocre advice in 2005, and it’s a complete waste of time in 2026.

The data tells a far different story. Informal referral relationships decay by 40% to 60% annually without structured reinforcement. That means even the handful of referrals you’re getting today will dry up next year if you don’t systematically maintain the relationship. And here’s the deeper problem: every CPA and estate attorney in your market has heard the same pitch from every Financial Advisor in town. “I provide comprehensive financial planning and I’ll take excellent care of your clients.” That sentence has become white noise. It’s the advisor equivalent of “I’m a people person” on a resume.

The reason most partnership conversations stall is painfully simple. Wealth Advisors walk into these meetings talking about what they want (referrals) instead of solving the problem the partner actually has. It’s a fundamental architectural flaw, and elite performers figured out the fix years ago.

Consider Michael T., a $2.2M revenue Advisor. Before he redesigned his approach, he was doing the standard CPA lunch circuit and receiving 8 to 10 referrals per year with a 40% conversion rate and an average new client AUM of $450,000. Not terrible, but nowhere near what those relationships could produce. After implementing a formalized Alliance approach, his numbers look like a different business entirely: 75+ qualified referrals annually, a 65% conversion rate, and an average new client AUM of $780,000. He didn’t change his market, his services, or his personality. He changed his system.

The Four Components of the Alliance Approach

This approach separates elite Wealth Managers from the rest of the pack, with its four interconnected components. This isn’t a linear checklist either. These elements reinforce each other, and the compounding effect is what creates the outsized results.

Strategic Partner Identification. Most Financial Advisors take a shotgun approach to partnerships, collecting business cards from any professional who will sit through a coffee meeting. Elite Private Wealth Managers are surgically precise. They profile potential partners across three criteria: client demographic overlap (do they serve your ideal client?), service philosophy alignment (do they deliver at a similar standard?), and business stage compatibility (are they growing and motivated, or coasting toward retirement?). The six highest-value partner categories are CPA and accounting firms, estate planning attorneys, business and corporate attorneys, P&C insurance professionals, business consultants, and banking or lending professionals. But here’s the insider move: the best partners aren’t the biggest firms. They’re the mid-sized, growth-oriented practices where your referrals actually move the needle for the partner’s business.

The Partner Value Proposition. This is where 90% of Wealth Advisors fail, and it’s honestly the most fixable problem in our industry. Walking into a CPA’s office and leading with “I provide great financial advice” is a death sentence. You sound exactly like the other fourteen advisors who pitched them this quarter. The Alliance approach flips the script entirely. Before you ever mention referrals, you identify your potential partner’s specific business challenges and position yourself as the solution. For CPAs, that might mean helping them expand their business consulting revenue by creating joint planning workshops for their business owner clients. For estate attorneys, it could mean providing ongoing portfolio analysis that keeps the attorney connected to families between estate updates. For business consultants, you become the financial planning resource that makes their exit planning services stickier. Each partner type requires a different value proposition, because each partner type has different business problems. If you’re using the same pitch for your CPA as you are for your estate attorney, you’re doing it wrong.

The Relationship Cultivation Engine. Here’s where most advisors fall apart even when they nail the initial approach. They get excited, have a great first meeting, maybe exchange a referral or two, and then let the relationship drift back into the occasional lunch purgatory. An alliance replaces sporadic socializing with a systematic cultivation engine: monthly value delivery (not monthly lunch requests), quarterly strategic planning sessions with your top three to five partners, joint educational workshops for partner clients, and technology-supported referral workflows that make it effortless for your partner to send you a name. The key is removing friction from the referral process while continuously demonstrating that you’re an asset to their practice, not just another mouth to feed at the networking luncheon.

Measurement and Optimization. You wouldn’t run your investment practice without performance benchmarks, so why would you run your partnership strategy blind? Elite Wealth Managers track referral volume, conversion rates, client satisfaction, and revenue generated per partner relationship on a quarterly basis. The benchmark you should be targeting: partnership-sourced clients should have acquisition costs 40% to 60% lower than direct marketing channels and retention rates 20% to 30% higher than self-sourced clients. If your numbers don’t look like that yet, you don’t have a partnership problem. You have a measurement problem.

The most productive COI relationships are based on systematic processes rather than personal rapport. Elite Wealth Managers don’t network. They architect.

The Q1 Partnership Sprint: Why This Week Matters

If you’ve been nodding along thinking “I’ll get to this eventually,” here’s your wake-up call. Q1 is objectively the best window for partnership development, and the advisors who move now will lock in referral flows that competitors cannot replicate six months from now.

The timing isn’t arbitrary. Right now, CPAs are deep in the trenches of tax season and they’re sitting across the table from clients who need financial planning help yesterday. They’re seeing the disorganized portfolios, the missed tax-loss harvesting opportunities, and the business owners with zero succession plans. These CPAs are actively looking for a Wealth Advisor they can trust with warm introductions. If you’re not in that CPA’s mental rolodex by mid-March, someone else will be.

Estate attorneys are processing year-end settlements and identifying families navigating wealth transitions. Business consultants are building annual strategic plans with their clients and realizing they need a financial planning partner to round out the offering. Every one of these professionals is more receptive to a well-structured alliance conversation in Q1 than at any other time of the year. By Q3, they’ll be too busy. By Q4, they’ll have already committed to someone else.

Your 30-day implementation timeline looks like this. Week one: identify your top ten potential partners using the Strategic Partner Identification Matrix and develop customized value propositions for your top three. Week two: schedule and execute approach meetings using the “Solve Their Problem First” framework. Week three: formalize your first one to two alliance agreements and establish referral workflow protocols. Week four: launch your monthly value delivery cadence and schedule your first quarterly strategic planning session. For the complete 90-Day Partnership Launch Plan with weekly milestones, the diagnostic tools inside the Advisor Tools section at Synseus.com walk you through every step of Module 7: Strategic Partnership Accelerators.

The Economics That Make This a No-Brainer

Let’s talk numbers, because the ROI on a properly built Alliance Architecture makes every other growth channel look like a rounding error.

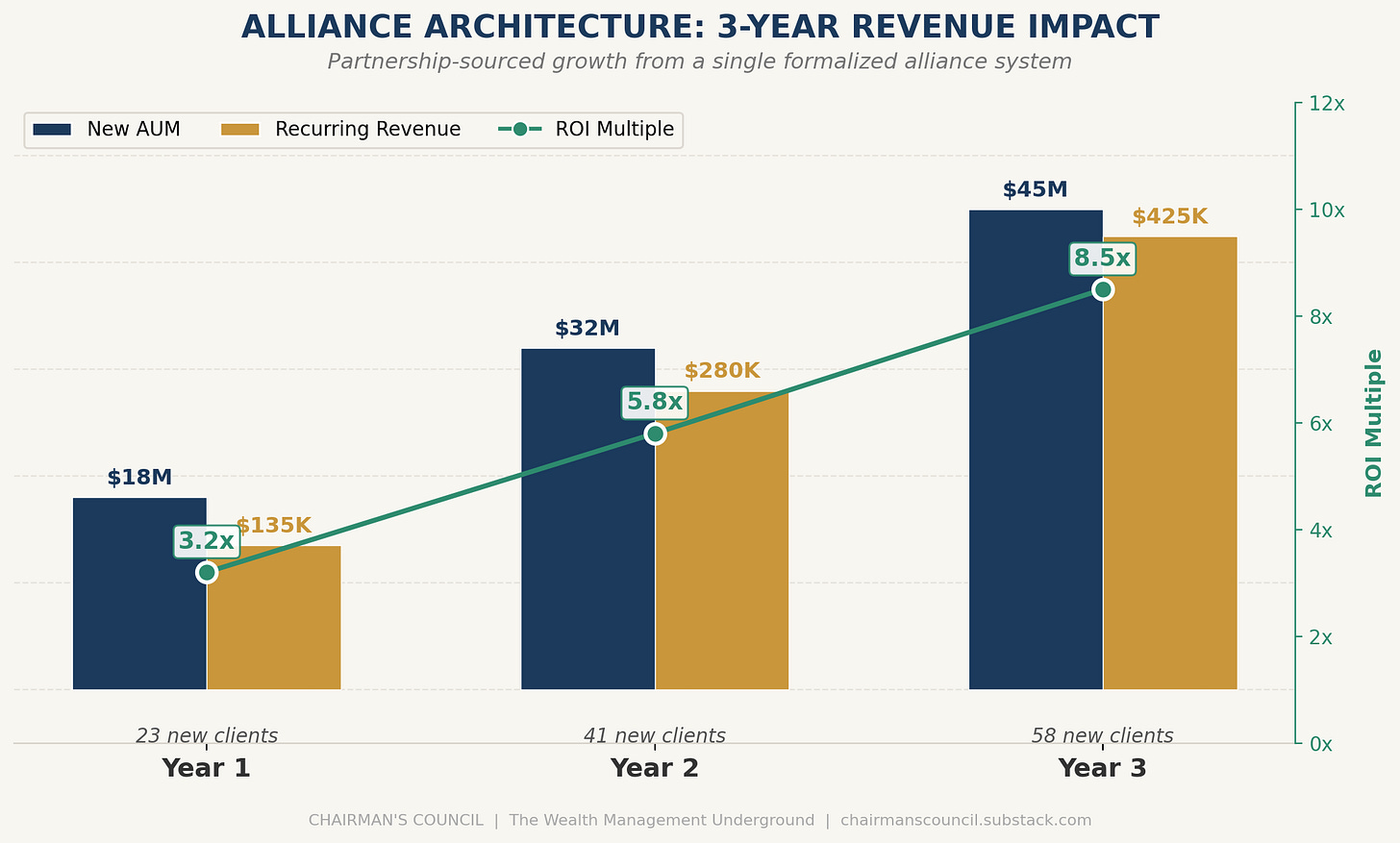

By year three, a well-executed partnership strategy can contribute $425,000 in annual recurring revenue with an 8.5x return on your partnership development investment. Now compare that to your other growth channels. The average seminar costs $3,500 per event and produces two to three prospects. Digital advertising runs $150 or more per lead with conversion rates in the single digits. Cold calling (if you’re still dialing for dollars) costs roughly $850 per acquired client when you factor in your time. Partnership-sourced clients arrive pre-qualified, pre-trusting, and with a warm introduction. They close faster, stay longer, and refer more.

The gap between Advisors who struggle to find prospects and those who have more opportunities than they can handle almost always comes down to one thing: their ability to create and leverage strategic partnerships. This isn’t networking. This isn’t relationship building. This is business architecture, and the Wealth Managers who treat it that way are the ones writing $1M+ production numbers.

Build Your Alliance Architecture This Week

The full Strategic Partnership Accelerators framework is available inside the Advisor Tools at Synseus.com. Module 7 provides the complete diagnostic assessment, interactive planning tools, and AI-powered coaching to transform informal networking into a systematic partnership engine that compounds year over year.

The advisors who build these alliances in Q1 will own the referral pipeline in their markets. The ones who wait will spend the rest of 2026 wondering why their CPA never calls back.

Don’t be the second advisor. Be the architect.

Chairman’s Council delivers unconventional strategies for ambitious Wealth Management professionals, Financial Advisors, and Private Wealth Managers targeting exponential AUM and revenue growth. Subscribe to access the full strategy library, implementation kits, and the tools that separate High Producers from everyone else.

[Subscribe to Chairman’s Council →]