The Metrics That Matter: Most Advisors Are Tracking The Wrong Numbers

How Do You Stack Up Against Top Performers Comes Down to the Essentials

You think you're performing better than you actually are.

Don't take it personally. It's human nature. Ask any group of advisors how they're doing, and 90% will tell you they're "above average." Ask them about their revenue, client acquisition, or business development activities, and suddenly everyone's an overachiever who just hasn't hit their stride yet.

Here's the thing: I've analyzed enough advisor practices to see the actual numbers behind the industry BS. I know what top performing financial advisors really do versus what average advisors think they do. And the gap isn't just significant—it's measurable, specific, and honestly, a little embarrassing for most of the industry.

So let's cut through the feel-good conference rhetoric and figure out where you actually stack up against the wealth management performance leaders who are genuinely crushing it. Fair warning: this might hurt your feelings. But it might also change your business.

Because here's what I've learned after watching hundreds of practices: the best financial advisor benchmarks are the simple, yet essential elements of your practice and they don't lie.

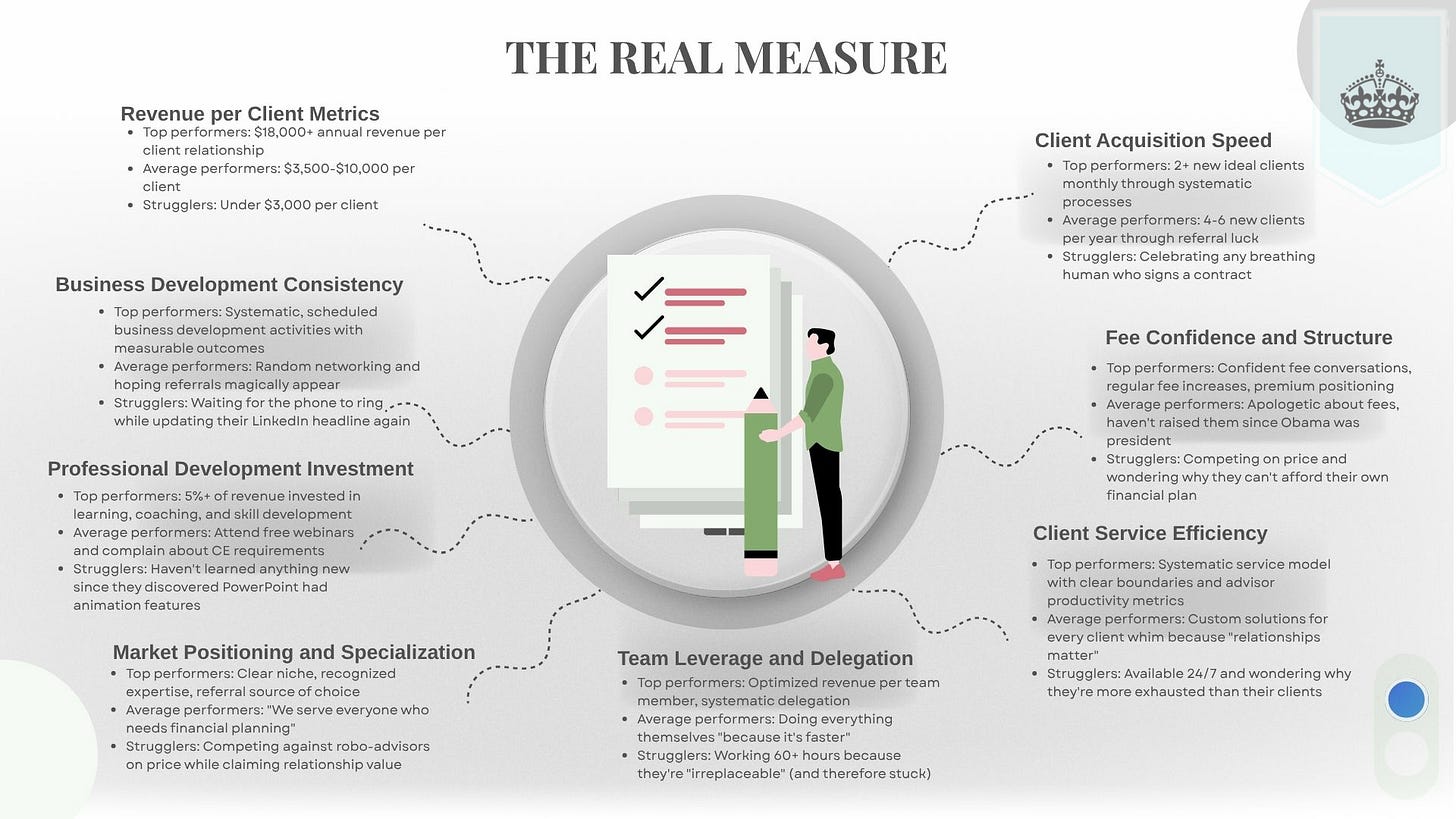

The Real Measure

1. Revenue per Client Metrics: The Great Divider