This Is How Elite Advisors Build Exclusive Referral Relationships While Competitors Get Ghosted

The CPA Strategy

The average Wealth Advisor receives fewer than three CPA referrals per year. Three. That’s after dozens of networking lunches, holiday gift baskets with your logo on them, and enough “let’s grab coffee sometime” emails to fill a landfill.

Meanwhile, a small cohort of elite Financial Advisors, roughly the top 8%, generate 40 to 75+ qualified referrals annually from CPA relationships alone. Same profession. Same pool of accountants. Wildly different results. This gap is arguably just their unique methodology. Clearly, what these top performers are doing looks nothing like what your BD’s marketing department is recommending.

The traditional CPA networking playbook isn’t just ineffective, it’s actively working against you.

What’s Your Advisor Growth Archetype?

Discover your natural advisory style, unlock personalized growth strategies, and find hidden revenue opportunities tailored to how you actually operate.

Growth Hacker - Aggressive, risk-tolerant, ambitious

Relationship Builder - Client-first, long-term, trust-focused

Technical Analyst - Data-driven, systematic, precision-focused

Lifestyle Optimizer - Balance-focused, efficiency-driven, quality of life

Empire Builder - Legacy-focused, team-builder, visionary

Take the Free 2-Minute Assessment to find your edge today.

Autopsy of the Grip-and-Grin Lunch

The average CPA with a decent practice gets pitched by 15 to 30 Wealth Advisors every year. Your carefully crafted lunch invitation lands alongside a dozen identical pitches. To the CPA, you’re not a strategic partner. You’re Tuesday’s lunch appointment.

Here’s the deeper problem. When you show up asking “How can we refer business to each other?”, you’re revealing that you don’t understand what CPAs actually need. They don’t need another advisor to refer to, they already have three in their phone who send holiday wine. What they need are solutions to their business challenges: expanding consulting revenue, retaining clients outgrowing basic tax prep, and delivering more value without hiring more staff.

Then there’s the follow-up fade. 87% of advisor-CPA relationships die within 90 days of the first lunch. No systematic cultivation. No consistent value delivery. Just a sporadic email in October and a branded calendar in December. The CPA forgets your name by Q2, and you’re back grinding the phones wondering why your COI strategy isn’t producing.

If this sounds familiar, it’s not personal. It’s structural. And that structural failure is actually your biggest opportunity, because almost every advisor in your market is making the exact same mistakes.

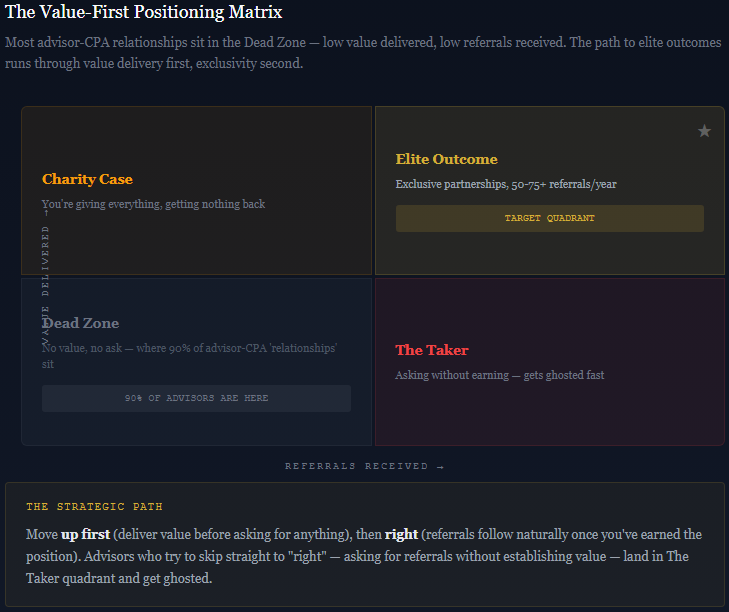

The Value-First Infiltration Methodology

The advisors generating $8M+ in annual partnership-sourced AUM aren’t networking. They’re infiltrating. There’s a difference.

The core principle is deceptively simple: instead of asking “Can you refer clients to me?”, elite Private Wealth Managers ask, “How can I help you build your business and solve your biggest client challenges?” That one shift changes everything, the power dynamic, the CPA’s receptivity, and the referral math.

The Intelligence Phase comes first, and most advisors skip it entirely. Before you pick up the phone, research the CPA firm’s business model, client demographics, and service gaps. You’re identifying two or three specific problems you can solve for their practice. Maybe they serve business owners approaching exit without a succession planning resource. Maybe their HNW clients are asking about estate planning coordination and the CPA is winging it. Identify the gap before you make contact.

The Entry Phase is where you diverge from the pack. Instead of a lunch invite, lead with a concrete deliverable. A co-branded educational workshop the CPA can offer to their clients. A white paper on tax-efficient wealth transfer they can distribute as a value-add. A client segmentation analysis showing which of their accounts are underserved on the financial planning side, complete with revenue implications. You’re not asking for anything. You’re arriving with something valuable, already built.

The data backs this up. Advisors who shift from “referral asking” to “value delivering” see referral volume increase by 300-500% within 18 months, with average new client AUM of $780,000 compared to $450,000 from traditional networking. That’s not a marginal improvement. That’s a fundamentally different business.

☰ The strategic foundation is yours. Below the fold is where it becomes a revenue engine, the exact integration and exclusivity approaches, the partnership structures generating $425K+ in annual recurring revenue, and the timing strategy that gives you a 90-day head start on every competitor in your market. This is Chairman’s Council territory.

[Continue reading with a Chairman’s Council membership →]