While Your Competitors Plan, Start Executing To Gain An Implementation Advantage

Capturing Market Share While Others Are Still 'Getting Organized

Here’s what separates $400K wealth advisors from $1.2M producers: The elite don’t plan better, they implement systematically. While your competitors are setting vague “grow 15%” goals right now, top producers are already executing month-by-month tactical plans that will double their revenue by Q4.

Be the Savage Operator: 2026 will be your year of execution arbitrage.

Most advisors will spend the year collecting strategies at conferences and webinars. Elite performers are building operating systems that turn those strategies into revenue.

The Implementation Gap That’s Costing You $300K+ Annually

Let’s address the elephant in every advisor’s office: that shelf full of conference binders, downloaded playbooks, and “game-changing” frameworks that never actually changed your game. Industry insiders call this the “shelf-ware syndrome” an estimated $50K worth of premium strategies gathering dust while you’re stuck in reactive mode.

The Bureau of Labor Statistics pegs median wealth advisor compensation at $99,580, while the top 10% clear $208,000+. But here’s where it gets interesting: elite Private Wealth Managers rapidly scale into seven figures using the exact same strategies you already know about. The difference? They have an integrated implementation framework, not a collection of disconnected tactics.

Data from top-performing practices reveals something fascinating: advisors who achieve 25% of their annual revenue target by March 31 ultimately hit 140% of their year-end goals. Those who lag in Q1? They struggle to reach even 73% of targets by December. Translation: Your first 90 days don’t just matter, they mathematically determine your entire year.

The gap between knowledge and execution has never been wider, creating unprecedented opportunity for disciplined implementers. While the industry obsesses over the next hot strategy, the real competitive advantage lies in systematically executing what already works.

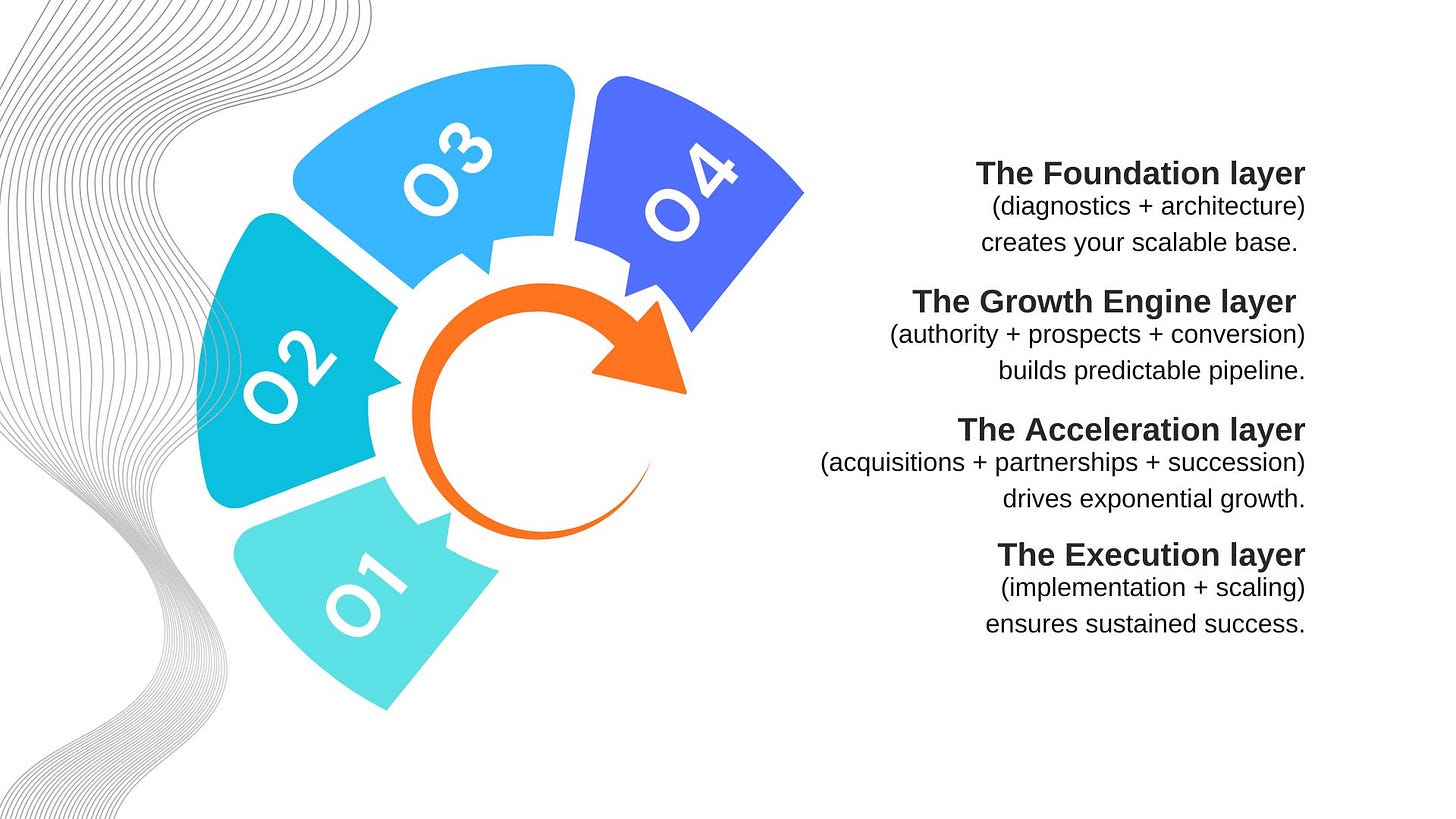

Use This Framework To Dominate in 2026

Elite producers operate from annual implementation roadmaps, not quarterly “priorities.” Here’s the actual operating system top-tier Private Wealth Managers use to orchestrate breakthrough years.

Q1: Foundation & Momentum (January-March)

January: Revenue Diagnostics & Baseline Establishment

Start with comprehensive practice assessment, not the superficial kind, but deep diagnostics that reveal exactly where revenue is hiding in your current book. Your mission: identify your top three bottlenecks constraining growth and establish your 2026 revenue baseline with 90-day milestones.

The quick win: Systematic review of your top 50 clients for asset consolidation opportunities. Why January? Client psychology. They’ve just received year-end statements and are evaluating their entire financial picture. Elite advisors capture 80% of annual asset consolidation in Q1 while competitors are still “getting organized.” Expected impact: $50K-$150K in additional AUM within 60 days.

💰 PREMIUM UNLOCKS: THE $300K+ IMPLEMENTATION GAP

January’s diagnostic framework above reveals where revenue is hiding. The complete system below shows you exactly how to capture it:

✅ February: Architecture & Positioning

✅ March: Prospect Generation Engine

✅ Q2: Acceleration & Expansion (April-June)

✅ Q3: Systematization & Scale (July-September)

✅ Q4: Results Maximization & 2027 Positioning (October-December)

✅ BONUS SECTION: The Reverse Acquisition Strategy. How to Get Bought Out While Building Your Practice

Elite producers implement while competitors keep planning. Which will you be?

ACCESS COMPLETE FRAMEWORK → Premium membership: $449.99 $337.49/year (get 25% off 1st year subscription). One successful February fee conversation pays for itself.

February: Architecture & Positioning