"The difference between advisors who plateau at $500K and those who scale beyond $2M isn't talent or market conditions—it's their willingness to invest in outcomes that won't materialize for 18-36 months."

Over the many years I’ve work with many successful advisory practices, I’ve come to appreciate a subtle nuance about the elite groups: the advisors making the most money aren't the ones chasing every shiny object or obsessing over this month's numbers. They're the ones playing a completely different game—one that most advisors don't even realize exists.

While you're stressing about your quarterly AUM growth (trust me, I get it, the whole industry obsesses over quarterly AUM numbers), elite advisors are quietly building systems that will dominate their markets for years. And here's the twist: it's not because they're smarter or work harder. It's because they've figured out that patience isn't just a virtue, it's a profit center.

The numbers don't lie: Advisors who think in 3-5 year cycles consistently outperform their peers by 40-60% in annual revenue. We're talking about a median of $1.4M annually versus $1.0M for the "quick win" crowd. That's a $400,000 difference that compounds every single year.

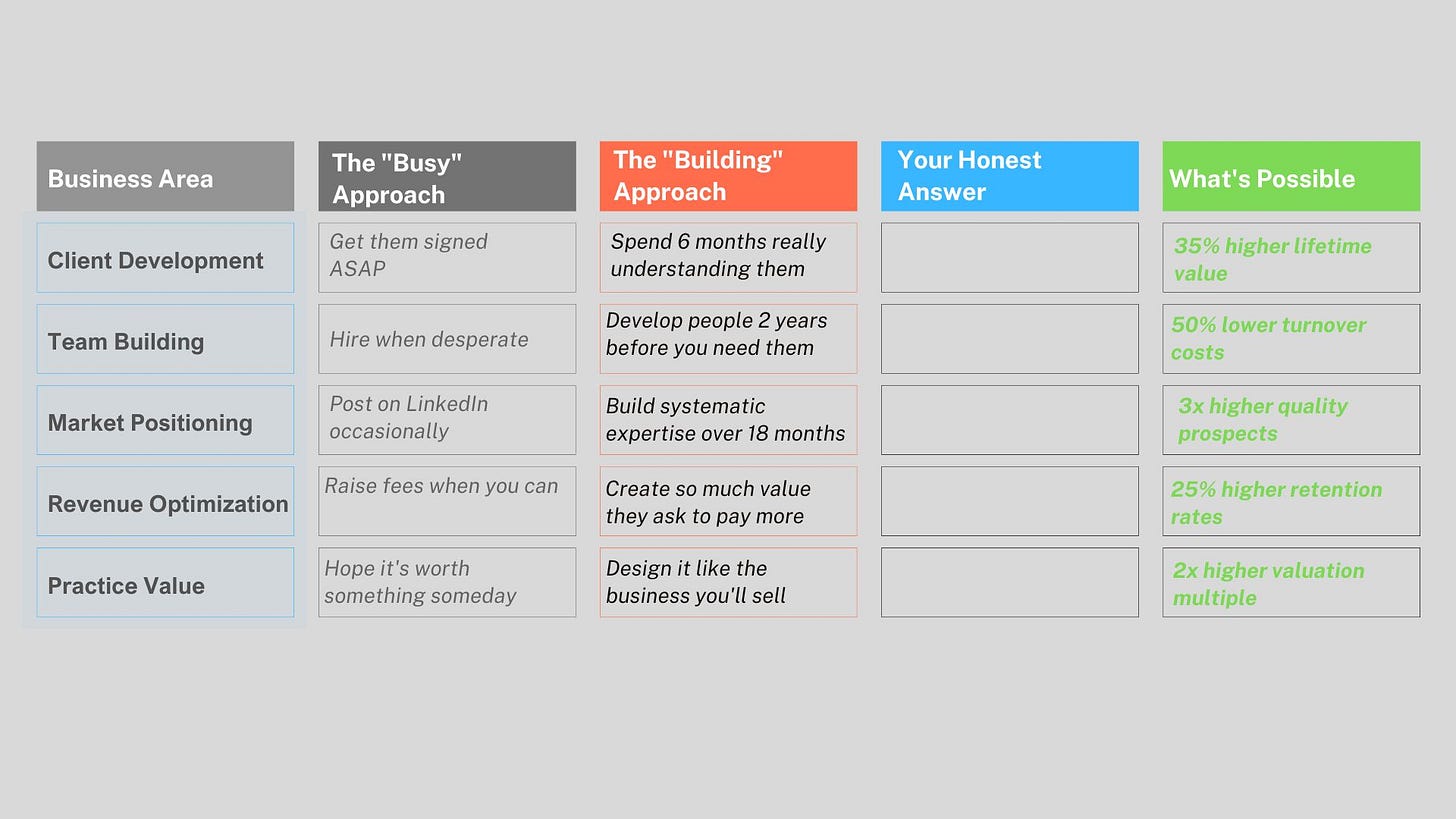

The Real Question: Are You Building or Just Busy?

Let me ask you something. When you think about your practice, are you building something that gets stronger every year, or are you just staying busy trying to hit this month's targets?

Here's a simple way to figure out where you stand:

If you're honest (and I hope you are), most of us start in the left column. The advisors making real money have systematically moved to the right. And yes, it takes longer to see results. But once you do, the results are extraordinary.

If you just realized you're stuck in the "busy" column instead of the "building" column, you're not alone—and you're not stuck there. The Chairman's Council Toolkit shows you exactly how to shift from short-term thinking to long-term wealth creation. Get immediate access to our 3-Year Client Development Framework and start building relationships that compound into millions. [Access Premium Tools →]

How Elite Advisors Think About Client Relationships

Here's where most advisors get it wrong. You think the client relationship starts when they sign the paperwork. Elite advisors know it really starts about 18 months later, when you've moved beyond the "honeymoon phase" and into something deeper.

Let me show you what this looks like in practice:

The 3-Year Client Transformation (That Most Advisors Never See)

Year 1: You're Still Proving Yourself

You're doing deep discovery (not just about money, but about what really matters to them)

You're educating them about things they've never considered

You're handling their first few "tests" (market volatility, family issues, whatever comes up)

What happens: They stop shopping you against other advisors and start trusting your judgment

Year 2: You Become Their Go-To Person

They're introducing you to their kids, their CPA, their attorney

You're involved in major life decisions (not just financial ones)

They start asking your opinion on things outside your expertise (because they trust you)

What happens: Their referrals become higher quality, and they're willing to consolidate more assets

Year 3: You're Family

They're actively promoting you to everyone they know

Their adult children consider you "their" advisor too

They include you in family planning discussions and major celebrations

What happens: This becomes your most profitable and enjoyable client relationship

Here's the thing: most advisors never get to Year 3 because they're too busy chasing new clients to properly develop the ones they have. But the advisors who do? They're building relationships that last 15-20 years and generate millions in lifetime value.

The math is simple: A client you properly develop in Year 1 will generate 2.5x more lifetime value than one you just "close and service." But it requires investing time and energy with no immediate payoff. That's strategic patience.

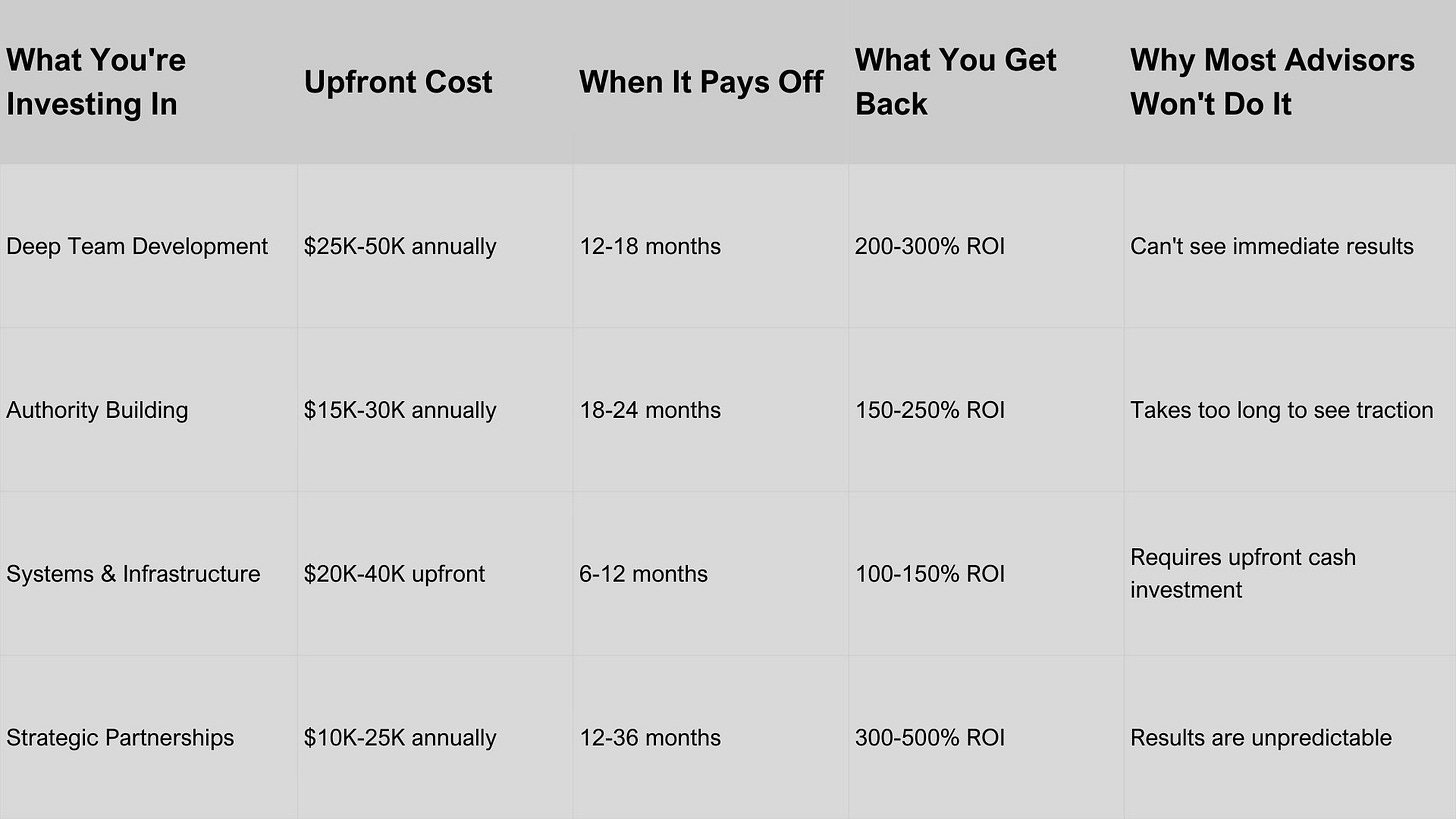

The Investment Mindset That Changes Everything

OK, here's where I want to mess with your head a little bit. What if I told you that the best investments you can make in your practice won't pay off for 12-36 months? Would you still make them?

Most advisors won't. They want to see results within 90 days, preferably in the next 30. But elite advisors have learned to think like private equity investors—they're looking for investments that compound over years, not quarters.

Check this out:

Here's the secret: Elite advisors allocate 30-35% of their annual revenue to these kinds of investments. Average advisors? Less than 15%. And they wonder why they can't break through growth plateaus.

The advisors making $2M+ aren't necessarily smarter than you. They're just willing to write checks today for results they won't see until next year.

Ready to start investing like the advisors making $2M+? Get our proven templates for team development, authority building, and strategic partnerships that elite advisors use to dominate their markets. Stop guessing—start implementing with data-driven precision. [Get Your Investment Roadmap →]

The Monthly Habits That Compound Into Millions