McKinsey Just Mapped the Death of the Average Advisor.

Here's What the Survivors Are Building Right Now.

CHAIRMAN'S COUNCIL

Chairman's Council offers unconventional strategies for ambitious Wealth Management professionals targeting exponential AUM and Revenue Growth.

Subscribe now!

Recent posts

Newsletters

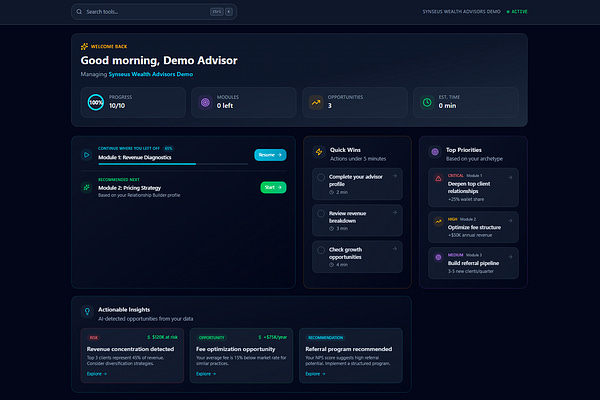

Strategic insights for breaking through growth plateaus and scaling barriers. Features in-depth analysis of growth ceiling patterns, market intelligence, competitive positioning strategies, and proven architecture for advisors ready to accelerate beyond their current revenue constraints.

Complete frameworks for identifying, evaluating, and executing strategic practice acquisitions. From deal sourcing and valuation models to financing strategies and seamless integration playbooks—compress your growth timeline by 3-5 years through smart acquisitions.

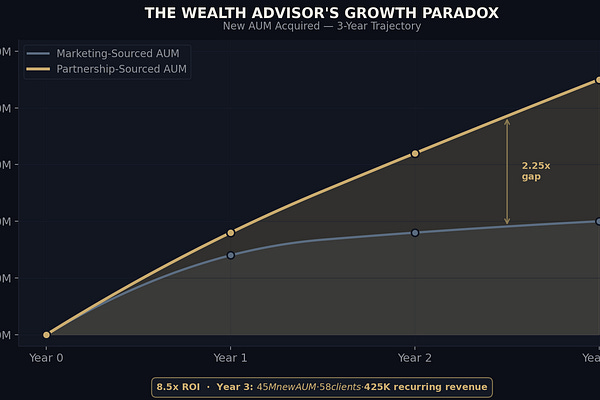

The core revenue acceleration engine covering predictable prospect generation, high-conversion client acquisition, and systematic scaling strategies. Transform your practice from unpredictable growth to a predictable revenue machine that consistently delivers practice growth.

Defensive excellence focused on client retention, fee optimization, and business risk management. Advanced strategies for protecting and enhancing your existing client relationships while building enterprise value and succession readiness.

Exclusive Downloadable Content for Premium Members